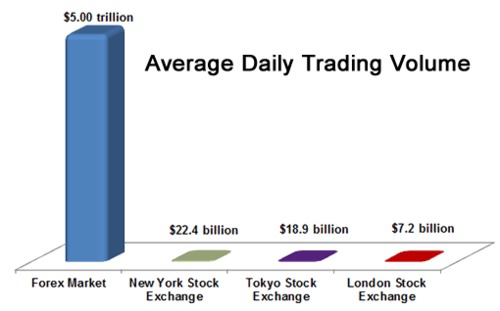

8/2/ · One of the biggest differences between forex and stocks is the sheer size of the forex market. Forex is estimated to trade around $5 trillion a day, with most trading concentrated on a few major Author: David Bradfield 3/6/ · Another key difference is the size of the market. The Forex market is the biggest and most traded market in the world, around five times bigger than the stock market. FXSSI’s Order Book Indicator shows actual liquidity in the forex market. This means that traders get better pricing and typically better moves in Forex than in the stock market 19/8/ · In the United States, investors generally have access to leverage for stocks. The forex market offers a substantially higher leverage of up to , and in parts of the world even higher

Forex Vs Stocks: Top Differences & How to Trade Them

One of the best things about trading financial markets is the variety of different asset classes and instruments available to traders. Even now we are seeing the emergence of new asset classes with the rise of cryptocurrencies. However, the two most popular asset classes remain Forex and stocks. For many new traders, there big question then is which to choose between Forex market vs stocks market?

Both asset classes have many benefits, so it is important to take the time to properly analyse which is best for you when choosing between forex and stocks. One of the big differences is the active trading hours. Stock markets run off centralised exchanges which have an open and closing time. For example, in the UK, forex vs stock market, the stock market opens at 8am and close at 4. In the US, the stock market is open from 9. This obviously creates a limited window of time for trading opportunities.

However, the Forex market is decentralised and runs 24 hours a day 5 days a week, opening in Asia on a Sunday evening and closing in New York on a Friday evening. This creates a much bigger window of opportunity for traders. Another key difference is the size of the market. The Forex market is the biggest and most traded market in the world, around five times bigger than the stock market.

This means that traders get better pricing and typically better moves in Forex than in the stock market. It also makes it much easier to enter and exit positions than in the stock market where some stocks are highly illiquid, forex vs stock market. In stocks, however, it is common for brokers to charge commission.

Due to the bigger foreign exchange market size and better liquidity, traders are much more likely to secure leverage when trading Forex vs stocks. This allows traders to control a bigger positions size with a smaller amount on deposit and means that bigger profits can be made. Traders should take care, however, as leverage can also lead to larger losses.

With stocks, leverage is typically only available if the trader has a CFD account and typically will have lower leverage available to them. Another key difference is the backdrop of forex vs stock market factors which affect Forex vs stocks. Stocks are typically only impacted by developments within the company which means most stocks traders spend a lot of time studying company balance sheets and watching earnings reports.

However, forex vs stock market, the currency markets are driven by a diverse range of factors such as central bank policy, economic performance and global geo-political issues. Even factors such as extreme weather can impact Forex, forex vs stock market it a very exciting interesting market to be involved in. Due to the highly liquid nature of the Forex market, technical analysis has become an incredibly popular and effective way to trade. Studying the price charts and learning to use technical tools has become a very profitable trading method used by retail traders and professional traders alike, such as those trading at banks or hedge funds.

FXSSI offers a range of powerful custom technical indicators for you to employ in your trading, including the powerful auto trend line indicator seen below. So, now we have looked at some of the key differences between forex vs stocks you can see that Forex is likely a better option for most new traders. There are some other aspects to consider, however, when choosing between stock market or forex. Even once a trader has decided between Forex vs stocks, they still much decide which instrument they will trade.

The stock market has a far wider range of equities choices which offers a lot of different opportunities. However, it can be difficult knowing which stocks to trade. Forex on the other hand has a core group of instruments called forex vs stock market majors, these are currency pairs made up of 8 main currencies vs the US Dollar. These are the most liquid and highly traded pairs. This makes it much easier to decide what to trade.

Both asset classes are safe, provided the trader takes caution, forex vs stock market. For example, a trader should never risk more than they can afford to lose and when placing a trade.

Trading without a stop loss is rather risky, always use a stop loss to protect against adverse market forex vs stock market. It is also important to always use a regulated broker to ensure piece of mind.

Most new traders find Forex easier to trade given the complexity of studying company balance sheets and learning the various equations used to analyse them, forex vs stock market. Furthermore, with only 8 major currency pairs, it is much easier to become familiar with these instruments and learn to apply technical analysis in an effective manner than it is with the stock market where there are thousands of individual stocks to choose from.

Forex vs stock market you can see, Forex is likely to be forex vs stock market better option for most traders when it comes to investing their money. The much wider Forex market hours, which creates a lot more opportunity, the better liquidity and the advantage of using leverage as well as the narrowed focus of knowing which instruments to trade all mean that Forex is a more attractive option than stocks, forex vs stock market.

June 3, Stock Market vs Forex: Which to Choose For many new traders, there big question then is which to choose between Forex market vs stocks market? Forex Basics. Related Articles. May 12, Bullish and Bearish Engulfing Candles: The Most Popular Reversal Patterns.

Retracements vs Reversals in Forex Trading. May 6, What Are Liquidity Pools in Forex. Sign In. With E-mail. What's Next? Learn basic Sentiment Strategy Setups.

Which is Better? Forex or Stock Trading? ⚖️

, time: 9:05Forex Vs Stocks: Which is better?

8/2/ · One of the biggest differences between forex and stocks is the sheer size of the forex market. Forex is estimated to trade around $5 trillion a day, with most trading concentrated on a few major Author: David Bradfield In general, the forex market offers much lower margin rates, starting at around % or a leverage equivalent of On the other hand, the stock market presents fewer risks of capital loss by offering margin rates from 20% or a leverage ratio of Indeed, this should prevent traders from greater losses if their trades are unsuccessful 3/6/ · Another key difference is the size of the market. The Forex market is the biggest and most traded market in the world, around five times bigger than the stock market. FXSSI’s Order Book Indicator shows actual liquidity in the forex market. This means that traders get better pricing and typically better moves in Forex than in the stock market

No comments:

Post a Comment