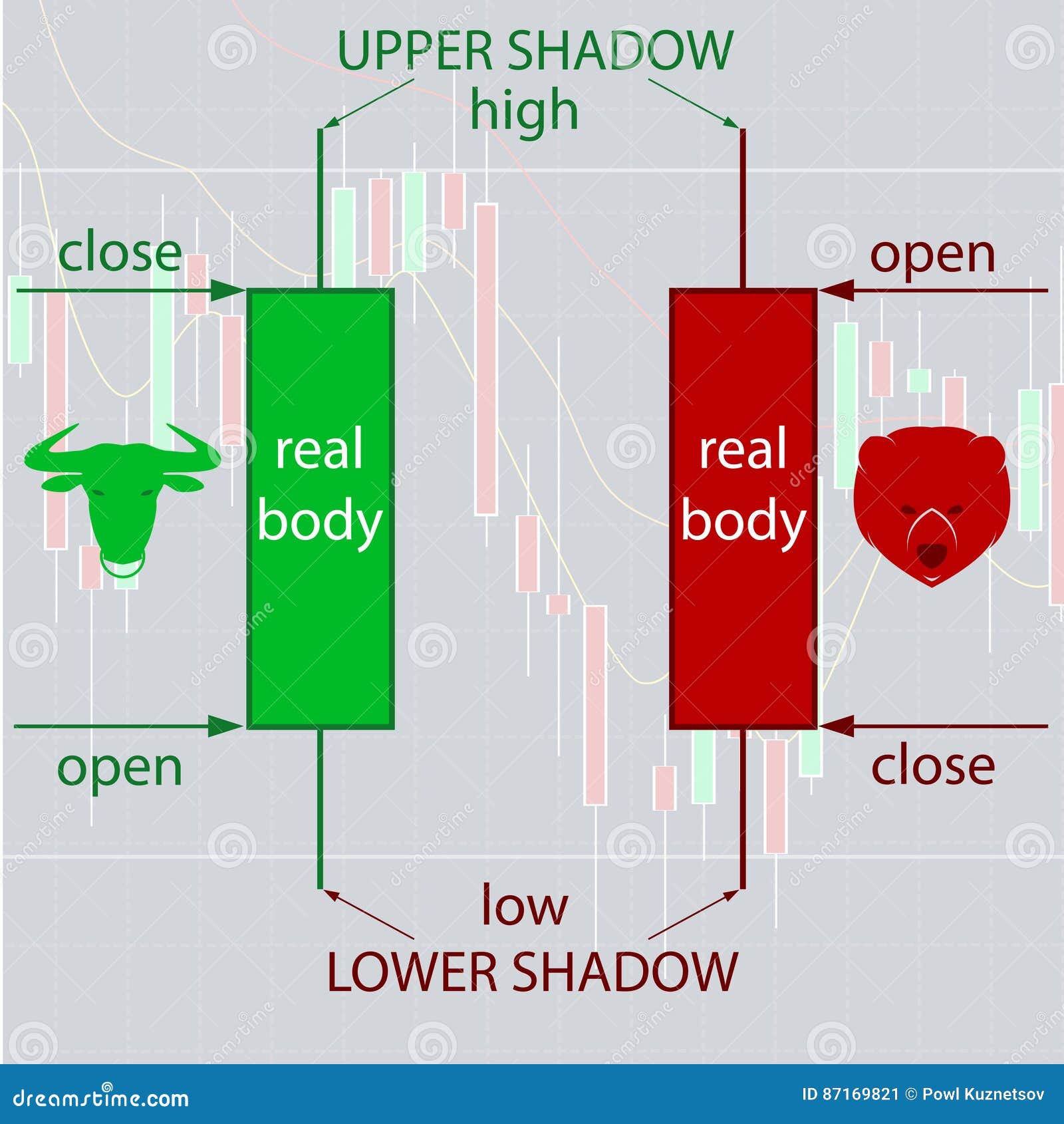

Japanese Candlesticks (or just CandleSticks) are a graphical representation of key levels within a defined time period. These are the open, close, high and low. They are particularly helpful for traders who want to get an idea of volatility in a particular range. Using CandleSticks with Binary Options Binary option trading on margin involves high risk, and is not suitable for all investors. As a leveraged product losses are able to exceed initial deposits and capital is at risk. Before deciding to trade binary options or any other financial instrument you should carefully consider your investment objectives, level of experience, and risk appetite 7 Candlestick Formations Every Binary Options Trader Must

How to use Japanese candlestick in Binary Trading

Hammer is usually a bullish pattern which means it is a very important signal when looking to buy call options. This is mainly because the outcome of this pattern is that the market prices are usually expected to move upwards and thus a trader should feel free to buy call options with the expectations of the prices moving to higher values.

Since a hammer is a bullish pattern, it means it forms after a previous downward trend and this should always be considered when a trader is trading after the formation of a hammer. Also the trader should also note that the formation of a hammer is followed by bear candlesticks which are usually trying to take the lows of the hammer and in the process provide the trader with the point to enter buy call options.

The hammer is a type of a candlestick and the most central item to look at is the fact that for a candlestick to be referred to as a hammer the candlestick analyze the candlestick, japanese candlesticks for binary options the length of its body and also measure and compare the body to the tail which is also commonly referred to as the shadow of the candlestick, japanese candlesticks for binary options.

For a candlestick to be referred to as a hammer, japanese candlesticks for binary options, the tail should have a minimum length of japanese candlesticks for binary options the actual length of the body of the candlestick, irrespective of whether it is a bull or bear candle. As a trader even if the tail appears to be longer than the body of the candle, you should seek to find out if the tail is twice or more as long as well the body before making a conclusion that it is a hammer.

The hammer is a powerful signal for a reversal. Therefore traders should be careful to identify them in the market so as make informed trading decisions. Sometimes in the financial markets, there may be opposing forces between japanese candlesticks for binary options factors pushing the prices up and the factors pushing the prices down. The market at such times seems to be undecided since it makes a huge move in one direction and then retraces back to the other side leaving very long tails therefore resulting to the formation of a type of candlestick known as a hammer.

In actual sense, a hammer shows a battle between a bullish trend and a bearish trend, as the bears try to dominate and bulls are also doing their japanese candlesticks for binary options to outdo the bears.

Therefore, after the formation of a hammer, japanese candlesticks for binary options, the trader should not anticipate to witness a rapid movement in prices since the bears japanese candlesticks for binary options usually not ready to give up their bearish trend and they are eager to push the market prices below the already established lows in the hammer candle. It is also worth noting that in trading currency Markets, a trader should understand that the market is normally dominated by traders who are usually pushed to take certain actions.

For instance, a trader may decide to trade short for a whole week and on Friday he or she wants to find a good point to exit the market. For the trader to close the short position, japanese candlesticks for binary options, he or she will have to buy and a squaring of a short position is normally seen as a strong upward candlestick that might look like a reversal candlestick.

This simply implies that trades should avoid trading hammers which are normally formed on Friday, but instead wait for the coming Monday so that they can open a trade. If the trader surely eels that the prices are great for placing a trade, the he or she should ensure that the expiration date is well set so o avoid the losses that can be attached to the hammer being a fake one and especially on Fridays.

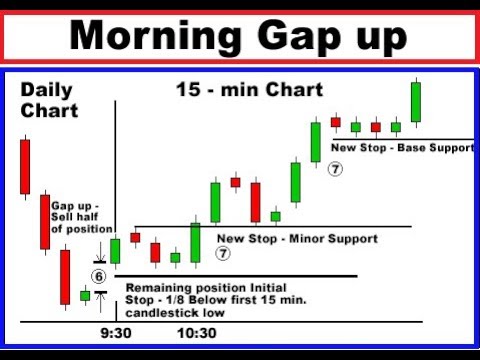

The trader should keep in mind that the larger the timeframe that the he or she is using, the better it is for the purposes of analysing the implications of a pattern as well as a reversal. In the currency markets, it is usually a battle of bullish candlesticks and bearish candlesticks. When bearish candlesticks form over a long time,the trader should look for a retracement so as to buy a call option. In short, the trader should wait for a hammer to form; retracement comes a short time after the formation of the hammer is completed.

For example, if a trader is trading on a daily chart and a hammer is formed, then the trader should wait for the retracement to come in the early hours of the following day. The retracement does not come on the same day the hammer is formed. If a trader is trading a call option and the market prices breaks the lows that were established by a previously formed hammer, then the trader should look at reversing the trade so that he or she can trade on a put japanese candlesticks for binary options. This is because the previous pattern becomes invalid and the reasons that had caused the trader to place a call option are no longer valid.

But in such cases the trader should split his or her investments into options with short term expiration periods since the market is still very much volatile and it is dominated by short bull and bear candlesticks. From the results obtained from the short term expiration options, the trader can then make up his or her mind on which type of option to place.

Your email address will not be published. Save my name, email, and website in this browser for the next time I comment. Necessary cookies are absolutely essential for the website to function properly.

This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information. Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website.

Japanese Candlesticks Formations — Hammer No Comments. Author Recent Posts. Latest posts by Marcio see all. The Biggest Obstacles in Trading japanese candlesticks for binary options March 29, 8 Money Management Techniques - January 4, What Is the Best Possible Time to Trade - October 26, Leave a Reply Cancel reply Your email address will not be published.

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish. Accept Read More. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website.

Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website.

These cookies will be stored in your browser only with your consent, japanese candlesticks for binary options. You also have the option to opt-out of these cookies. But opting out of some of these cookies may affect your browsing experience. Necessary Necessary. Non-necessary Non-necessary, japanese candlesticks for binary options.

How to Read Japanese Candlestick Charts?

, time: 5:39Candlestick Charts Explained - Trading the Patterns

Binary option trading on margin involves high risk, and is not suitable for all investors. As a leveraged product losses are able to exceed initial deposits and capital is at risk. Before deciding to trade binary options or any other financial instrument you should carefully consider your investment objectives, level of experience, and risk appetite Japanese Candlesticks (or just CandleSticks) are a graphical representation of key levels within a defined time period. These are the open, close, high and low. They are particularly helpful for traders who want to get an idea of volatility in a particular range. Using CandleSticks with Binary Options 27/7/ · The Japanese candlesticks are very helpful in defining the chart patterns. These patterns can indicate a reversal or the trend continuation. Reversal or continuation of a trend enables the trader to make profit. How to turn on the candles. 1. Switch your chart into Japanese candles (10 seconds for Turbo options, 30 seconds for binary options) blogger.comted Reading Time: 2 mins

No comments:

Post a Comment